421a tax abatement meaning

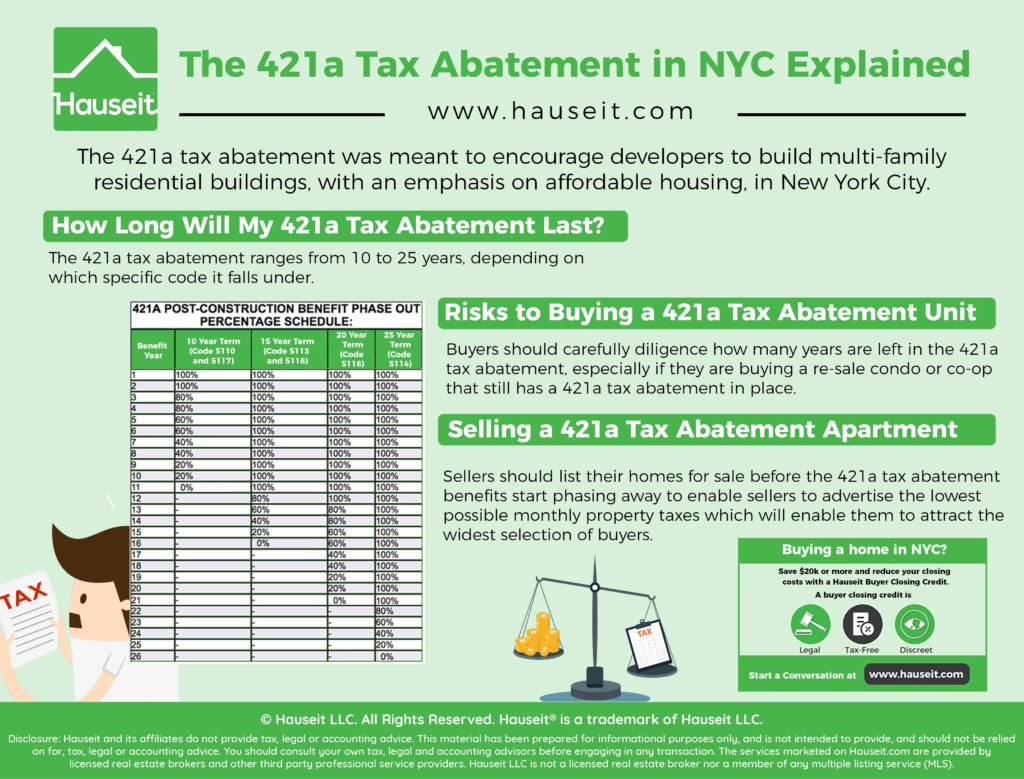

The exemption also applies to. This table shows the terms and the.

Nyc Real Estate Taxes Blooming Sky

In 421-a buildings where the tax benefits are for 10 or more years and provided that a 22 lease rider is offered by the owner and signed by the.

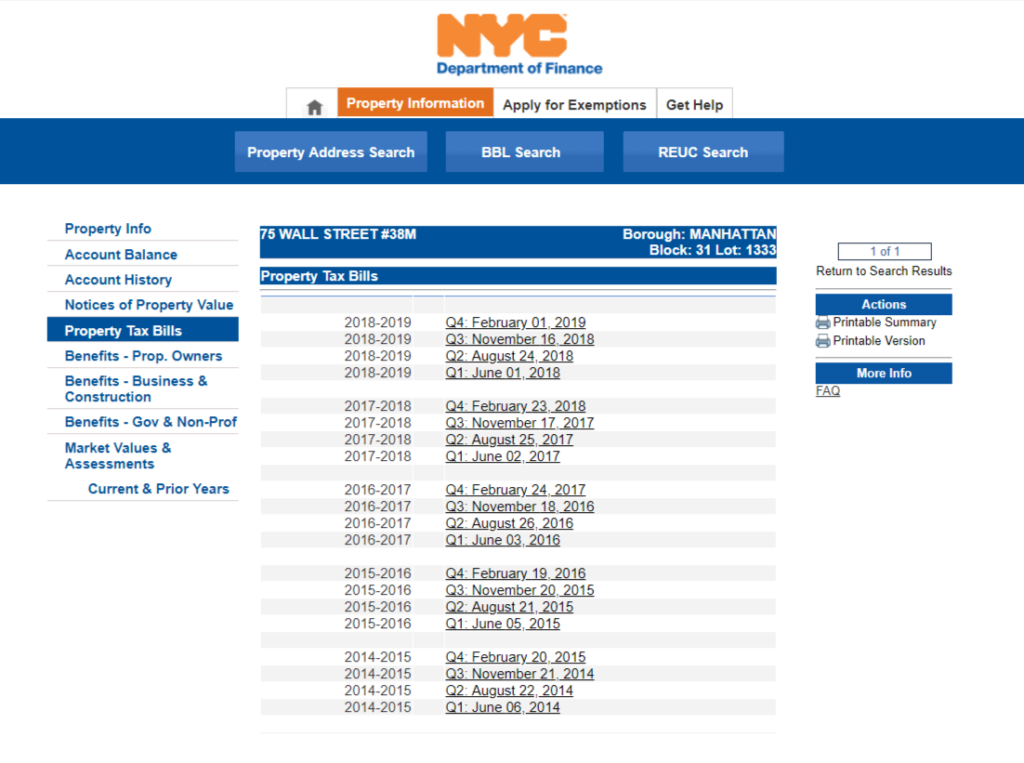

. How to Verify a 421a Tax Abatement. Here you would be able to see if there is a. The 421a tax abatement got its name from the section of New York Real Property Tax Law establishing it in 1971.

The J-51 tax abatement is unique for many reasons. They are still the most common type encountered by buyers in. Enter a propertys address.

Click on Benefits Business Construction on the left. The tiers matter the most since they tell you how long your abatement is good for. Homeowners can receive a 7000 exemption on their propertys assessed value for their main home if they reside in it on January 1.

The key 421a tax abatement benefit in NYC is the reduction in property taxes you owe for the term of the program. This table shows the terms and the. The second-highest tax break an abatement for coops and condos cost 655 million last year.

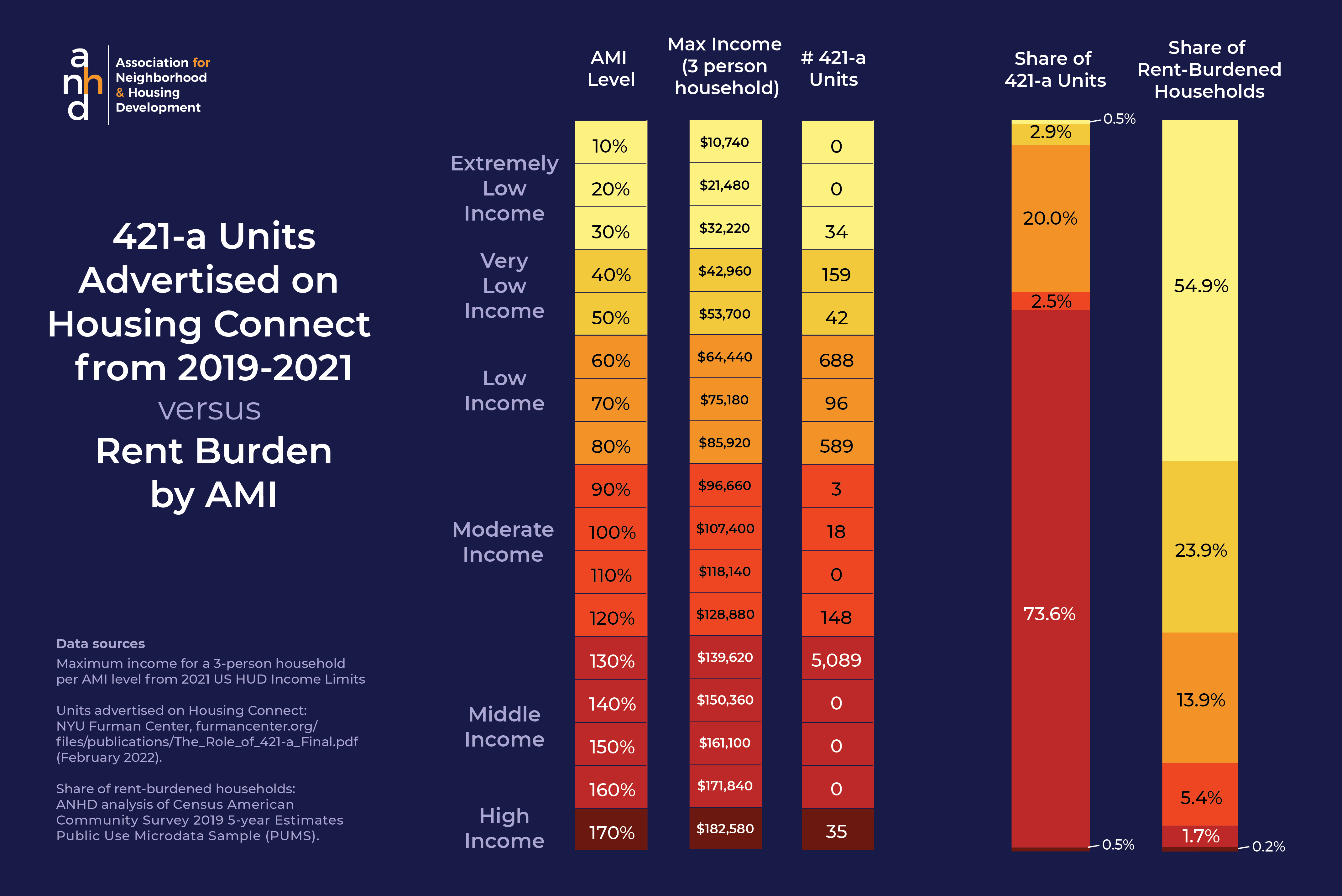

The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York. If your rental building is receiving a 421-a property tax benefit your building andor apartment may be subject to rent stabilization and the. In NYC 421-a tax abatements were introduced in 1971 and were implemented to encourage developers to develop unused and underutilized land by offering them reduced.

Second the J-51 program is a. If your property appears in the list of 421a exemptions currently being processed for FY19-20 at the following link 421a exemption and you have a question please Contact Us. First of all the J-51 abatement is rare compared to the more famous 421a program.

The end of the 421a housing-construction abatement means that the states property tax laws must be reformed. What happens after 421a expires. It was created in the 1970s to encourage development and originally didnt have any provisions for affordable.

May 30 2022 622pm. What is a 421a surcharge. The 421a tax abatement is a program that lowers your property tax bill.

The longer the term of the abatement ie. Homebuyers can understand the true meaning of the abatement by knowing when it will expire. You can have a 10-year 15-year 20-year or 25-year term.

The 421a tax abatement is a tax bill. Tax Abatement in California. More than half or 56 of all the citys multifamily residential units created in.

Although the current 421a expiration is nearly a year away it can take 18 to 24 months to design and construct a new building in New York City. Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

What Is A Tax Abatement Should You Buy A Home With One Localize

A Tenant S Guide To 421 A The City S Biggest Tax Break For Developers And Landlords The City

5 Nyc Condos For Sale In Buildings With A 421a Tax Abatement Still In Place

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Buying Condo With A 421a Tax Abatement R Nyc

Liberating Data From Nyc Property Tax Bills Chris Whong

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatement What It Is And How You Can Benefit From It

An Efficient Use Of Public Dollars A Closer Look At The Market Effects Of The 421 A Tax Break For Condos

What Is The 421g Tax Abatement In Nyc Hauseit

What Is A Tax Abatement Should You Buy A Home With One Localize

What Is The 421g Tax Abatement In Nyc Youtube

Nyc Real Estate Taxes Blooming Sky

Developers Struggle To Sell 421a Sites As Building Deadline Looms

Is 421 A Dead Where To Find Nyc S Remaining Tax Abatement Deals 6sqft

421a Affordable New York Metropolitan Realty Exemptions

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube